“Tokenizing Real-World Assets: How Blockchain is Revolutioni

June 16, 2025 | by Sophia Vance

Tokenizing Real-World Assets: The Blockchain Revolution Shaking Up Finance

By Sophia Vance — Financial analyst & crypto commentator. Making complex markets simple for everyday investors.

Forget the hype for a moment—look at the numbers. By 2030, Boston Consulting Group predicts $16 trillion in tokenized assets could flood traditional and digital markets. Overnight, the notion of “real-world assets” (RWAs) on-chain shifted from improbable to inevitable. If you’re watching tokenization and blockchain with side-eye skepticism, you’re not just missing out—you’re willfully ignoring the next phase of financial engineering.

Dissecting Tokenization: Not Your Average Buzzword

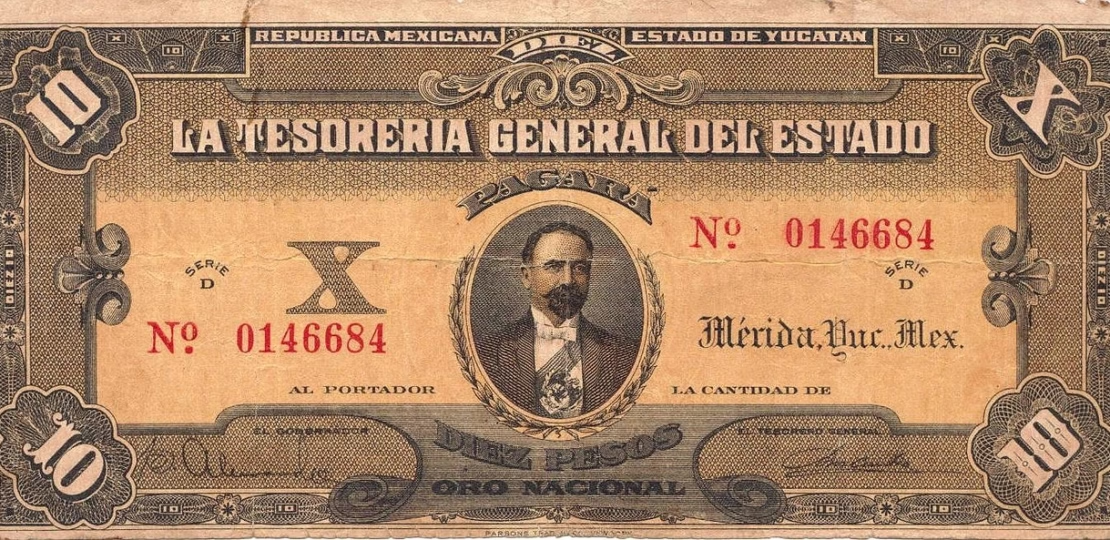

Tokenization is the process of representing ownership rights of tangible assets—think real estate, art, gold, corporate bonds—on a blockchain. Each asset, fragmented and digitized, is issued as a cryptographic token. These tokens can be programmed to mirror complex legal agreements, enforce compliance, or automate dividend payouts.

In years past, “digital assets” meant only Bitcoin, Ethereum, DeFi coins—purely digital abstractions.

The new wave is about bridging the iron-clad world of property, commodities, and financial instruments with programmable, immutable, 24/7 global blockchains.

From Art to Apartments: What’s Actually Being Tokenized?

- Real Estate — Entire buildings and even single apartments are fractionalized, letting global investors own and trade $500 slices of prime real estate, which traditionally required millions upfront.

- Commodities — Gold, silver, and diamonds are being tokenized, slashing settlement times and unlocking fractional ownership that lowers the historic buy-ins.

- Private Equity & Debt — VC investments, private company shares, and corporate bonds are tokenized to boost liquidity and simplify cross-border access.

- Luxury Goods — Watches, cars, rare wines—any hard-to-slice asset suddenly fits in your digital wallet as a certified, transferrable token.

The Immediate Advantages: Not Hype, Just Hard Numbers

1. Liquidity Unleashed: Traditionally, real-world assets meant slow-moving, illiquid markets. Tokenize a rental property? Its ownership can be as liquid as trading Apple stock.

2. Transparency & Security: The blockchain ledger gives buyers and regulators a tamper-proof, auditable trail—eliminating months of paperwork and gnarly legal bottlenecks.

3. Fractionalization = Democratization: A Picasso worth $50 million isn’t just for ultra-high-net-worth types. Tokenization lets anyone own—and later trade—a sliver.

Take a look at Ondo Finance, Franklin Templeton, and JPMorgan’s Onyx platform. They are already tokenizing treasuries and money market funds, drawing in new classes of global investors and reducing the cost of compliance.

“By 2028, Goldman Sachs expects at least 10% of all global assets will have some form of digital representation on blockchains.”

Challenges: A Reality Check Before You Dive In

No sharp market transition comes risk-free. Regulators in the EU, US, and Asia are playing catch-up, but oversight and legal clarity are still forming. Interoperability—moving tokens across chains and platforms—is a stumbling block. And underlying custodial risk remains: if your gold bar is tokenized, you’d better trust where it’s stored in the real world.

Yet, despite these headwinds, institutional momentum is unstoppable. The programmable nature of tokens is solving age-old problems: automating cap tables, expediting settlements, and even embedding governance into the asset itself.

Foresight: The Multi-Billion Dollar Floodgates are Opening

The rise of tokenized RWAs isn’t just a financial experiment; it’s a tectonic shift in how we perceive ownership and liquidity. As regulatory frameworks clarify and infrastructure matures, expect a migration of institutional capital. BlackRock, Citi, and HSBC aren’t just dabbling—they’re building.

For the mindful investor or forward-thinking institution, this is your call to move beyond crypto speculation and into the practical, lucrative mechanics of tokenized real-world assets.

Pack your skepticism, but don’t pack it too tight. Tokenization is not a fad—it’s becoming the backbone of tomorrow’s financial markets. Smart money isn’t waiting on the sidelines. Neither should you.

RELATED POSTS

View all